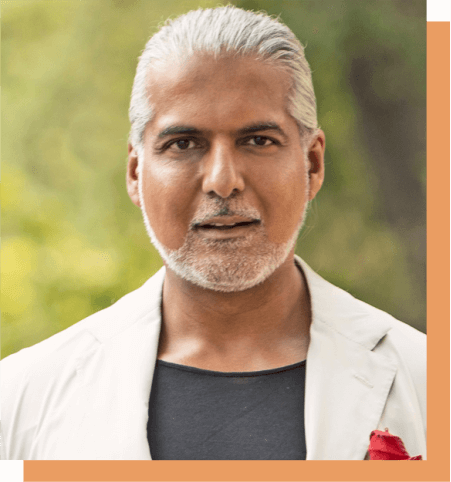

About Arif Bhalwani

Arif Bhalwani was born in Uganda, but racism and xenophobia forced his family to leave their home with nothing. The family spent several years in a refugee camp in Austria, before arriving in Canada.

These difficult early years, marked by uncertainty and privation, greatly impacted Arif’s perspectives on work, resiliency, and opportunity.

He started various ventures growing up in Canada and sold his first business when he was a teenager. By the time he was 23, he had started eight successful small businesses generating between $400,000 and $4,000,000 in revenues. He then invested in and helped manage the turnaround of a Canadian construction company under the mentorship of the CEO of Pinnacle Investments, a U.S. venture capital firm and family office. That led to Arif co-founding and running Pinnacle Capital, and its credit affiliate, Pinnacle Credit, in Canada.

Dr. David Alexander, who worked with Arif Bhalwani at Pinnacle Capital in 2000 after stepping down as CEO of The CIT Group in Canada, which acquired his equipment financing company, conceived the idea of starting an alternative lender that would meet the complex financing needs of companies ignored and underserved by banks. He and Arif Bhalwani founded Third Eye Capital, which is today of one Canada’s leading alternative lending firms.

At Third Eye Capital, Arif Bhalwani has led more than $4.5 billion in investments across a range of Canadian industries, including in the technology, sustainability, traditional and alternative energy, mining, construction services, transportation, and healthcare sectors.

Arif has also served as a director and advisor to several private and public companies as well as prominent industry associations. He was the youngest member of the Canadian Advisory Committee to the ICC Banking Commission in Paris and the Canadian Working Group of the Business and Industry Advisory Committee to the OECD. Arif is currently a member of the CFA Institute, the Secured Finance Network, the Canadian Venture Capital and Private Equity Association, the Association for Corporate Growth, the Alternative Credit Council, and the Turnaround Management Association.